Dwain Northey (Gen X)

I ask the question because Dear Leader has proposed eliminating the income tax and instituting a base line 10% tariff on all imported products. This is essentially a regressive tax on middle and lower income people. I get the thought of no income tax sounds good but much to the dismay of the public a tariff is not a liability to importers because the corporations only pass the import tariff on to consumers. So let’s say your state has a sales tax of 7% and inflation is 3% that in itself is 10% to everything you buy now let’s add another 10% to that because as we know must of the things we buy are imported.

How tariffs are supposed to work is by causing an increase on the price of an imported product to encourage the purchase of non imported products leveling the playing field so to speak. The best way to impose tariffs is through federal legislation not by executive order because no company or industry will ramp up production of a product to compete with a tariffed import if that tariff only last 3-4 years. The mistake effective tariff lasts 10 years or more and also subsidizes the U.S. market of the tariffed product. Solar Panels is a prime example… tariff Chinese solar panels @100% but in turn subsidized American solar industry to ramp up production here so that in 10 years the American made panels are abundant more technology advanced and less expensive than the imported panels.

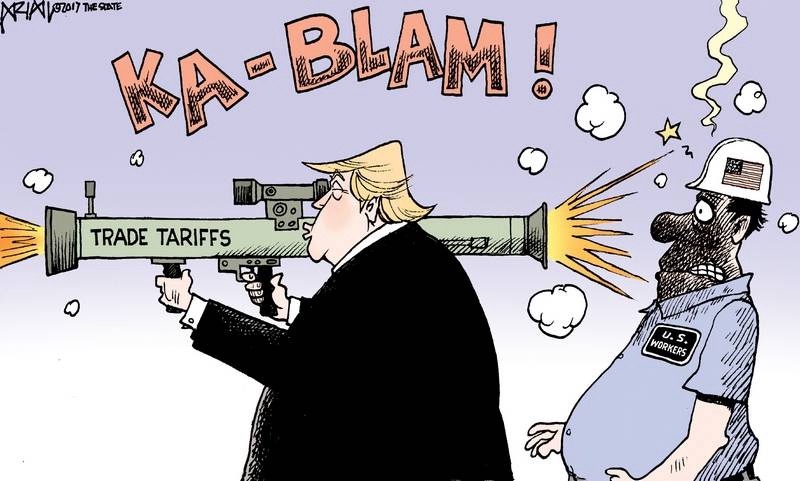

Tariffs are supposed to be designed to support local industry, not hurt local consumers.